jersey city property tax calculator

New Jersey Property Tax Rates. There may also be additional tax rates that apply for specific purposes such as parks or libraries.

Am I Paying Too Much In Property Tax Civic Parent

First fill in the value for your current NJ Real Estate Tax Assessment in the field below then select your County and City and press the Calculate button.

. As mentioned above property taxes are usually tax deductible on your New Jersey income tax return. In Person - The Tax Collectors office is open 830 am. Two rivers title is licensed in nj ny pa ct md nc va and fl.

New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations. A quick and efficient way to compare salaries in Jersey review income tax deductions for income in Jersey and estimate your tax returns for your Salary in JerseyThe Jersey Tax Calculator is a diverse tool and we may refer to it as the Jersey wage calculator salary.

How Do You Calculate Property Tax In Ontario. Jersey city property tax calculator. NJ Transfer Tax Calculator.

City of Jersey City. Your tax exemption for marginal relief. Your other sources of taxable income.

Your Effective Property Tax Rate would be 03726 lower than the official property tax rate of 0614770. The amount of profit. Tax bills are mailed annually in July.

By using this website you acknowledge that you have read understood and agreed to the above conditions. The table below shows the 26 cities in California that charge an additional city transfer tax in addition to the standard 011 California county transfer tax. Just a 1 difference in property value can put your transfer tax into the next tax bracket adding an additional 125000 in tax.

Box 2025 Jersey City NJ 07303. If you are going to live in NJ and work in NYC youre probably wondering how youll be paying taxes. Paying tax on income from property.

Our free NJ Transfer Tax calculator provides an estimate of the Realty Transfer Fee RTF that will be owed when selling real property in New Jersey. Dividing what the current years property assessment values stand at by multiplying them by City Tax Rates with the City Building Fund Levy approved by Council and the Education Tax Rate set by the Government of Ontario determines your property tax bill. City of Jersey City PO.

91 00006 00001A 90 HUDSON STREET View Pay. Online Inquiry Payment. Overall homeowners pay the most property taxes in new jersey which has some of the highest effective tax rates in the country.

Property Taxes - City of Jersey City Jersey City Real Estate Tax The Jersey City sales tax rate is. Senior Citizens selling primary residences blind or disabled persons and sellers of low or affordable income homes with resale controls or. Prior to 2018 the maximum property tax deduction was 10000.

26 14502 00010 10 HUDSON ST. Qualifier Property Location 18 14502 00011 20 HUDSON ST. In Bergen and Essex Counties west of New York City the average annual property tax bill is over 10000.

Municipalities counties and school districts all determine their own rates. The assessed value is determined by the tax assessor. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our New Jersey property tax records tool to get more accurate estimates for an individual property.

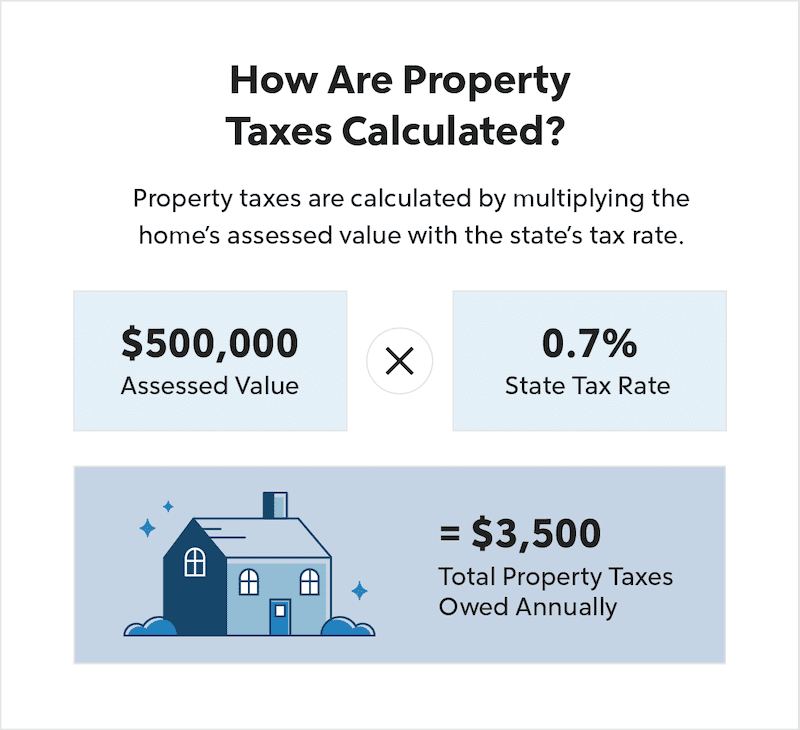

The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. The evaluation is a two step process.

Voters in Jersey City have endorse new Property Tax design to fund the arts offering a boost to industry with many now out of work. Customarily the New Jersey Transfer Tax is paid by the seller and the Mansion Tax on residential or commercial purchases of 1 million or more is paid by the buyer. In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations.

Calculate your take home pay in Jersey thats your salary after tax with the Jersey Salary Calculator. If youre ordinarily resident in Jersey for tax purposes. This guide will go over all you need to know from where youll file to the most significant benefit of living in New Jersey avoiding the city income tax.

The amount of tax will depend on. Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

The Headquarters of Two Rivers Title Company and. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our New Jersey property tax records tool to get more accurate estimates for an individual property. By Mail - Check or money order to.

Property tax rates in New Jersey vary significantly by city and county. Property tax rates are the rate used to determine how much property tax you pay based on the assessed value of your property. Lowest and Highest 2021 Property Tax Rates and Tax Bills for Hudson County NJ.

See if you are closing at our new corporate office. You will pay tax on any profit you make. Live in NJ Work in NYC.

Official records of the Jersey County Supervisor of Assessments and the Jersey County CollectorTreasurer may be reviewed at the Jersey County Government Building 200 North Lafayette St Jerseyville IL 62052. Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street. 9 2015 New Jersey Hourly Paycheck Calculator PaycheckCity.

Jersey City Union City Irvington Bloomfield etc. Starting with tax year 2018 you can now deduct up to 15000 of property taxes. The referendum which was voted on Tuesday along with a statewide decision about legalizing Marijuana received support from 64 percent of voters according to the New York Times.

See Rates for All Areas. You must declare any income on your tax return when you rent out property.

Property Taxes Highlands County Tax Collector

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

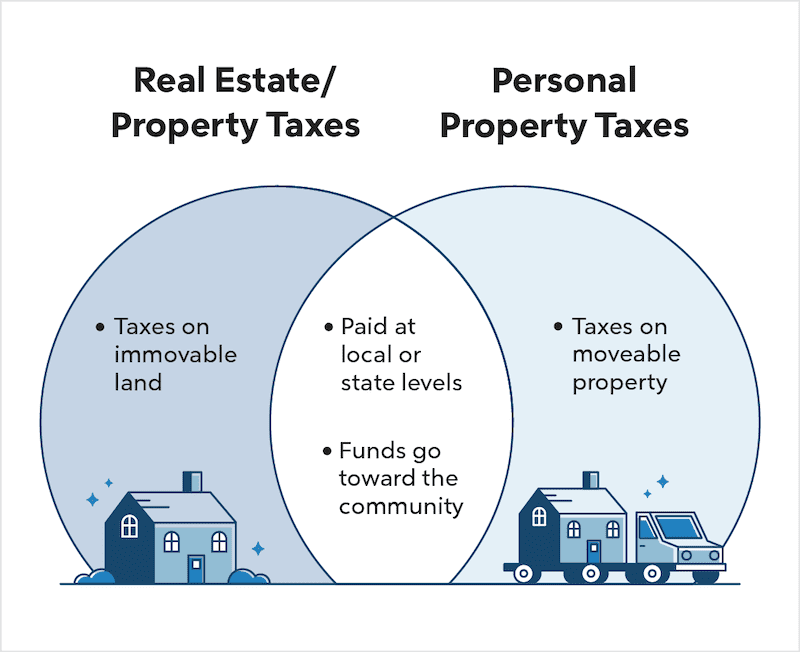

Real Estate Taxes Vs Property Taxes Quicken Loans

The Official Website Of City Of Union City Nj Tax Department

King County Wa Property Tax Calculator Smartasset

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Township Of Nutley New Jersey Property Tax Calculator

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Tax By State Ranking The Lowest To Highest

Property Tax Comparison By State For Cross State Businesses

How Taxes On Property Owned In Another State Work For 2022

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Real Estate Taxes Vs Property Taxes Quicken Loans

Township Of Nutley New Jersey Property Tax Calculator

Property Tax Definition Uses And How To Calculate Thestreet

Property Tax How To Calculate Local Considerations

Documentation For Loan Against Property What You Need To Know Tax Debt Relief Property Tax Tax Debt